Description

You have to remember something in the Nick’s Real Estate Masterclass. Most successful real estate folks (including me) understate the amount of risk they took to get where they are.

They’re in a different mode – wealth preservation – and they forget what its like to take that first leap with a little bit to lose and everything to gain. There is always risk. There is always unknown.

They’re in a different mode – wealth preservation – and they forget what its like to take that first leap with a little bit to lose and everything to gain. There is always risk. There is always unknown.

why does everyone need to learn Nick’s Real Estate Masterclass?

Because most real estate investors aren’t real estate investors at all. They run a service business and get paid in fees when they buy assets and get paid in promotes when they sell assets. When they stop buying and selling and refinancing they stop getting paid.

This is why I hate the standard real estate private equity structure. Find a way to hold real estate for a long time! That is how true wealth is made!

Real wealth is created when you hold great assets for a long time and let the magic happen.

Yes, I know you might need to 1031 or sell a few assets in the early days to upgrade and get the ball rolling faster, I get that.

But consider the fact that folks who have to buy and sell real estate to make money have to WORK to make that money. When they stop buying and selling the money stops coming in.

Find a way to structure your deals so you can make money along the way as you HOLD the assets. That’s when the magic happens!

What is Nick Huber’s jouney?

I’m not a master, and I have a lot to learn, but I’ve been there and done a lot of this stuff. My partner and I built a $2.9MM facility in 2016 and executed a $2MM cash-out refi in October of

2019. That was how that $2MM hit my checking account when I was 29 years old. Today, its worth $9.5 million.

Through aggressive depreciation (which we’ll cover), we haven’t paid a dollar of income taxes on our real estate portfolio and we won’t for a long time Real Estate Masterclass with Nick Huber

We’re utilizing syndication structures to bring on outside partners to grow. At the time of this writing, we have acquired over $75mm worth of self-storage (with another 20MM in the pipeline set to close in early 2022). We’re over 1 million square feet of storage under management. 45 properties. Over 8,500 units.

We have a team of 12 folks in the private equity company who help me find deals, raise money and close deals. 28 others are in the management company working on overseeing our assets.

We’re building and running two businesses simultaneously. A real estate private equity company (that raises the money and owns the deals) and a self storage management company (that operates the real estate and leases the units). Both are profitable and healthy.

What you will lean in the Nick’s Real Estate Masterclass?

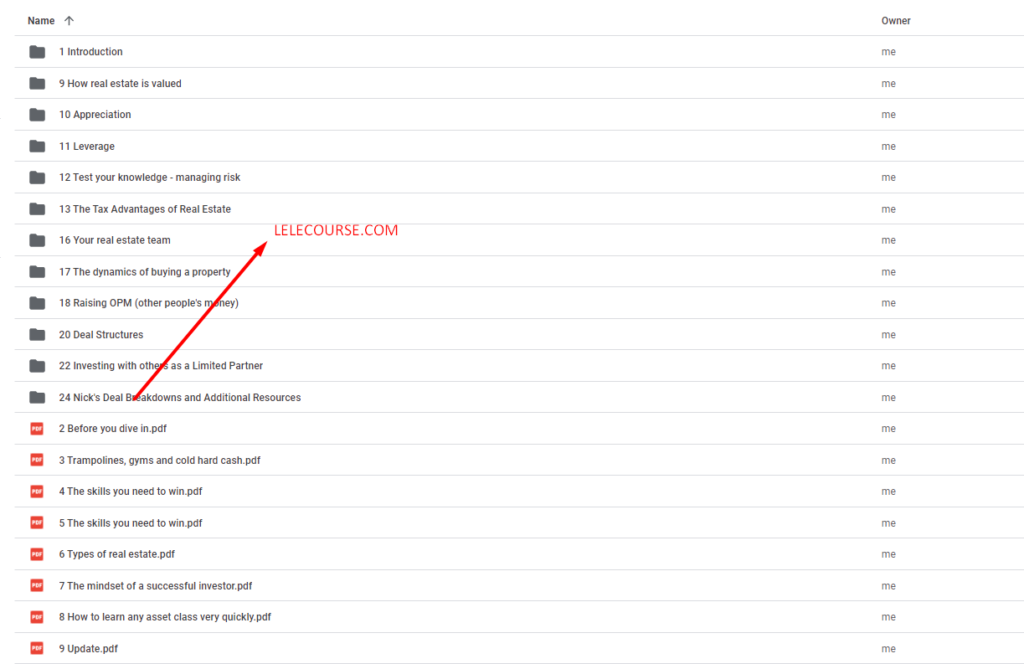

- Introduction to Real Estate Masterclass with Nick Huber

- Feedback and Comments

- How to create a lot of money out of thin air

- The skills you need to win

- Types of real estate

- The mindset of a successful investor

- How to learn any asset class very quickly

- How real estate is valued

- Appreciation

- Leverage

- Test your knowledge – managing risk

- Update

- The Tax Advantages of Real Estate

- The Risks of Real Estate

- How do I get started?

- Your real estate team

- The dynamics of buying a property

- Raising OPM (other people’s money)

- How to dominate Twitter

- Deal Structures

- How to scale your portfolio

- Investing with others as a Limited Partner

- My biggest mistakes in real estate

- Nick’s Deal Breakdowns and Additional Resources

- The case for buy-and-hold real estate

Refund is acceptable:

- Firstly, item is not as explained

- Secondly, Nick’s Real Estate Masterclass do not work the way it should.

- Thirdly, and most importantly, support extension can not be used.

Thank You For Choosing Us! We appreciate it.

Reviews

There are no reviews yet.